Hot Products

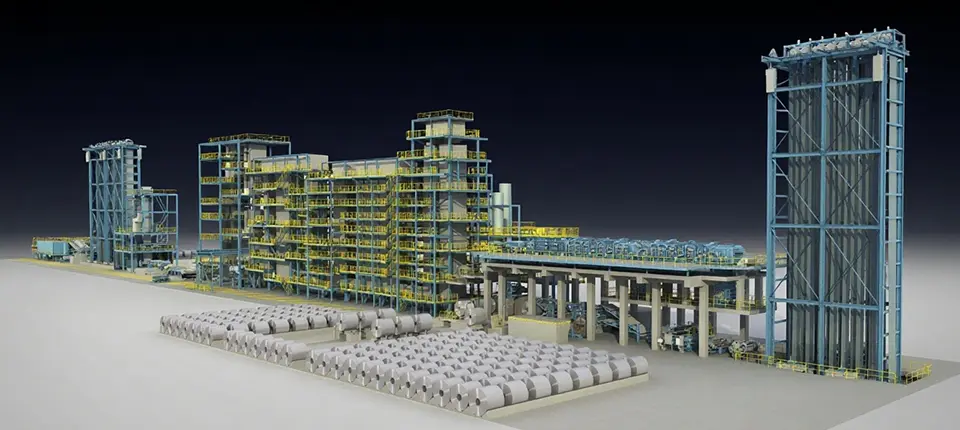

Specializing in the research, development, production and sales of galvanized sheets, color-coated sheets, film-coated sheets and metal decorative materials

News & Blog

CHUANG CAI

As strong as steel, as agile as intelligent manufacturing

Welcome to Chuangcai, a trusted choice for global sales

New era, new challenges, new opportunities. The global steel market is waiting for us to make great achievements. With the goal of building a grand brand, we adhere to steady operation and long-term development. At the same time, relying on strong human resources, rigorous management and business philosophy, through the accumulation of our own experience and the unremitting pursuit and improvement of the future, we constantly carry out self-innovation, technological innovation, management and business philosophy innovation, follow the trend of the development of the current international market, adhere to the business philosophy of people-oriented, quality-oriented enterprise, honesty and trustworthiness, and continuous innovation, and build the company into an internationally advanced multinational enterprise.

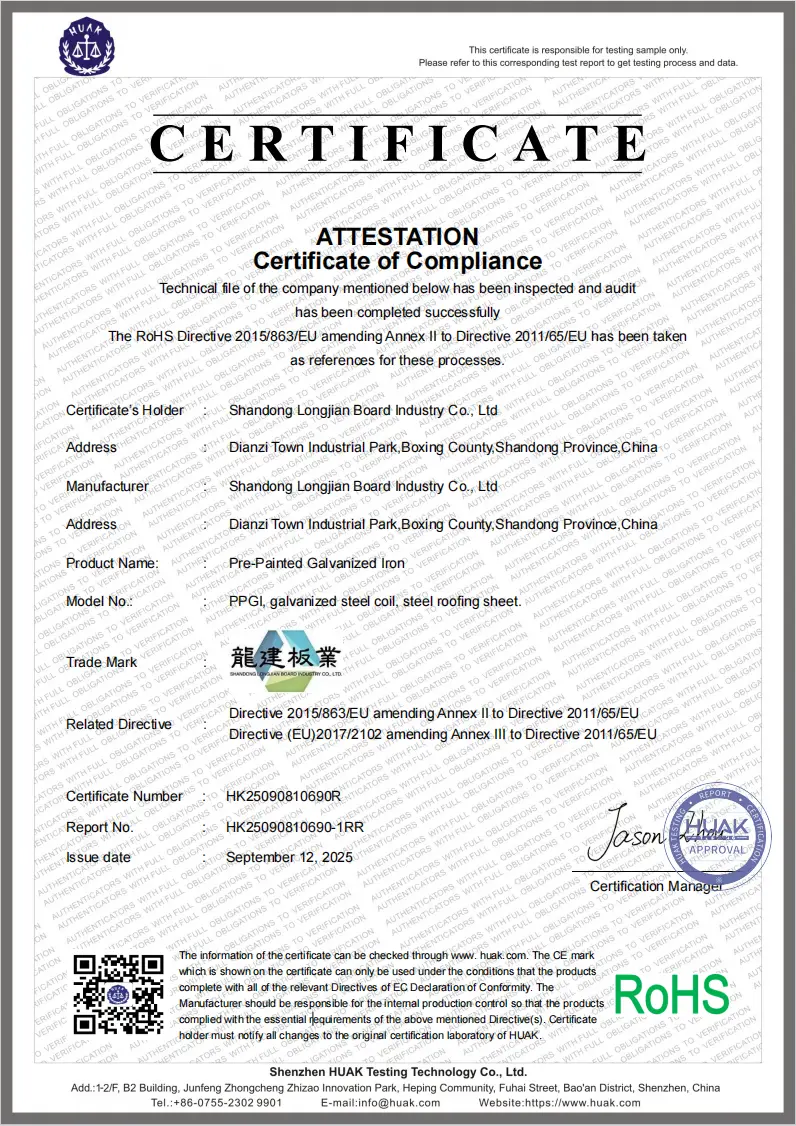

RoHS

CNAS

Enterprise Qualification

Enterprise Qualifications

Chuangcai Group Limited

Chuangcai Group Limited was established in 2012 as an integrated company specializing in design, research and development, production, and sales. The company primarily engages in the import and export of products such as color-coated steel sheets, galvanized steel sheets, and corrugated steel sheets. Since its inception, the company has adhered to the principles of putting people first and prioritizing customer satisfaction, consistently staying at the forefront of the industry. The company primarily exports to over 30 countries and regions worldwide, including South Korea, Southeast Asia, the Middle East, Africa, South America, and Europe.

Why Choose Us

High-quality metal sheet solutions

One-stop supply chain

Improve efficiency

Integrating processing, warehousing, logistics and export packaging, realizing rapid delivery from raw materials to finished products, and completely cutting off the delay pain points caused by the fragmentation of traditional links.

Comprehensive Certification

Quality Controllable

Products have passed international certifications such as SGS/BV/CIQ/ISO9001, ensuring that customers consistently obtain consistent performance in various application scenarios. Chuangcai Group ensures the stability of finished products for export orders and high customer satisfaction through a strict quality control system.