The Breakthrough Path for Steel Enterprises under the Transformation and Upgrading of the Construction Industry

Category: Industry News

Time:2025-09-03

The construction industry has always been a pillar of China's national economy. However, in recent years, weakening demand and low energy efficiency have severely constrained its development. In the future, the construction industry needs to shift from "incremental growth" to "quality improvement." Under the trend of industrial upgrading in construction, prefabricated buildings and modular production may gradually replace traditional construction methods. Facing such a transformation, construction steel suppliers should adjust their product structures according to actual conditions and appropriately extend their reach, evolving from material suppliers to supply chain partners.

The construction industry has always been a pillar industry of China's national economy, but in recent years, weakening demand and low energy efficiency have seriously hindered its development. In the future, the construction industry needs to shift from "incremental growth" to "quality improvement." Under the trend of industrial upgrading in construction, prefabricated buildings and modular production may gradually replace traditional construction methods. Facing such a transformation, construction steel supply companies should adjust their product structures according to actual conditions while appropriately moving downstream, transitioning from material suppliers to supply chain partners.

1. The construction industry maintains a solid position as a pillar industry of the national economy.

Over the past 70 years, China's construction industry has continuously expanded in scale and advanced technologically, serving as an important pillar of the national economy and employment.

Continuous scale expansion. In 1952, the total output value of the construction industry was only 5.7 billion yuan, in a state of nascent development; by 1956, the output value "exceeded 10 billion"; in 1988, it "exceeded 100 billion"; in 1998, it "exceeded 1 trillion"; and in 2011, it "exceeded 10 trillion." Since the 18th National Congress of the Communist Party, the construction industry has continued to grow rapidly, with a total output value of 32.7 trillion yuan in 2024, a year-on-year increase of 3.9%, and an average annual growth rate of about 6.0% from 2011 to 2024.

Continuous technological progress. A series of world-class engineering projects have been completed, such as the high-speed rail projects demonstrating China's engineering "speed," the Hong Kong-Zhuhai-Macao Bridge demonstrating "span," the Shanghai Tower demonstrating "height," and the independently developed third-generation nuclear power technology "Hualong One" global first demonstration project demonstrating "complexity." In terms of equipment level, the net value of enterprises' own mechanical equipment was only 30 million yuan in 1952, growing to 370 billion yuan by 2023; the technical equipment rate per person in the construction industry was 1,000 yuan/person in 1952, 2,300 yuan/person in 1980, and reached 7,200 yuan/person in 2023. International competitiveness has also continuously strengthened. According to the Engineering News-Record (ENR) Top 250 International Contractors list, 81 Chinese companies were listed in 2024, ranking first globally in both the number of companies and total international business volume.

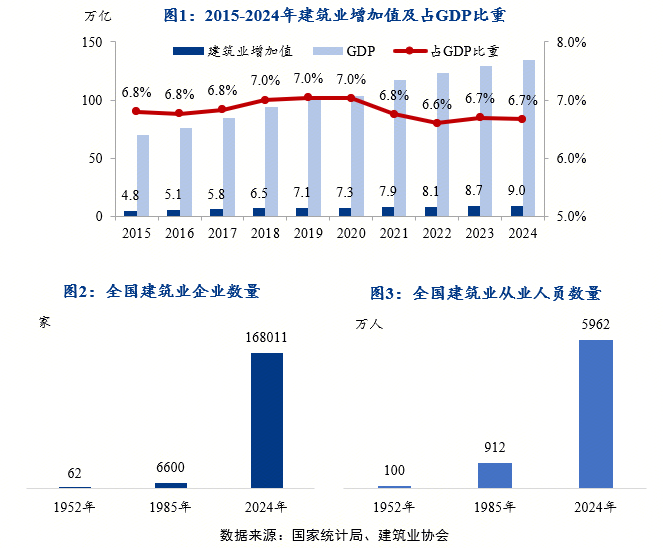

An important pillar of the national economy and employment. Since 2015, the added value of the construction industry has consistently accounted for more than 6.6% of GDP, reaching 6.7% in 2024, an increase of 3.0 percentage points compared to 1978. At the same time, its role in employment absorption is significant. By the end of 2024, there were 168,000 construction enterprises nationwide, with nearly 60 million construction workers, including about 42 million migrant workers, accounting for 14% of the total migrant worker population in the country.

2. The construction industry faces two major problems.

In recent years, the growth rate of the construction industry has gradually slowed, mainly facing two major issues: weakening demand and declining efficiency under low energy efficiency models.

(1) Weakening construction demand.

Population dividend fading. In 2024, China's population is 1.408 billion. Since 1949, the compound annual growth rate of the total population has been 1.3%. After 1970, China's population growth rate began to fluctuate downward; in 2022, 2023, and 2024, the total population decreased by 850,000, 2.08 million, and 1.39 million respectively. Meanwhile, the degree of population aging in China is gradually increasing, with the population aged 65 and above accounting for 15.4% in 2023; since 2000, the proportion of people aged 65 and above has exceeded 7%, entering an aging society; since 2014, the working-age population has declined, decreasing by more than 3 million annually from 2017 to 2024.

Infrastructure scale is already large enough. By the end of 2024, China ranks third globally in highway mileage and first in expressway mileage, 1.8 times that of the second-ranked United States; second globally in railway mileage and first in high-speed rail operating mileage, more than 10 times that of the second-ranked Spain. China has also completed a number of world-class large-scale infrastructure projects such as the Hong Kong-Zhuhai-Macao Bridge and the Three Gorges Hydropower Station.

Limited room for future urbanization rate increase. In 2024, China's urbanization rate is 67%. Although there is a gap compared to developed countries, the room for improvement is limited. As a largely agricultural country, China's national conditions determine that its urbanization rate ceiling is difficult to reach the 90% level of countries like Japan and South Korea. According to the seventh national census data, the urbanization rate of the 5-34 age group is about 71%, basically representing the upper limit of China's future urbanization, expected to reach about 70% around 2030.

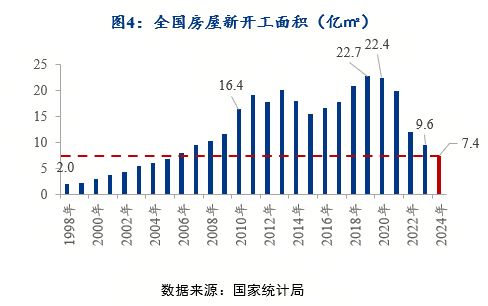

China has a huge stock of housing. In 2020, China's per capita housing area reached 41.76 square meters. With an average occupancy rate of 80%, the actual per capita housing area is 33.4 square meters, reaching the level of moderately developed countries. However, there is serious housing surplus and vacancy, with China's housing vacancy rate exceeding the 10% standard line, higher than most developed countries, and surplus is more severe in lower-tier cities. By the end of 2024, the construction area of houses in China reached 7.33 billion square meters, with per capita construction area exceeding 5 square meters. In 2024, the new housing start area has fallen back to the level of 2006, and considering the construction cycle, future demand for construction steel will continue to weaken.

(2) Declining corporate profits and inefficiency of traditional construction models.

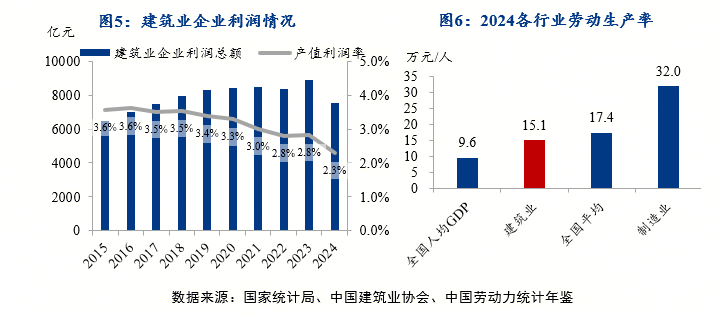

Profit margins continue to decline. The profit margin of the construction industry's output value (total profit/total output value) dropped from 3.6% in 2015 to 2.3% in 2024, a decrease of 0.43 percentage points from the previous year, remaining below 3% for three consecutive years. According to Ernst & Young, in 2024, 34 listed construction companies nationwide achieved a total operating income of 8,659.8 billion yuan, down 5.39% from 2023, and a total net profit of 210 billion yuan, down 15.31% from 2023, with an average net profit margin of 2.42%.

Fragmented production methods lead to insufficient labor productivity in the construction industry. In 2024, China's construction labor productivity was about 150,000 yuan per person, only 85% of the national average labor productivity and 47% of manufacturing labor productivity. Over the past decade, labor productivity in construction increased by about 77%, 18 percentage points lower than the national average and 34 percentage points lower than manufacturing. "Design only manages drawings, and construction follows drawings," with design, production, and construction separated, no coordination between stages, and conflicting interests among participants, resulting in lagging technological innovation and low labor productivity in the construction industry.

3. The way out for steel enterprises under the background of construction industry transformation and upgrading.

At present, China's construction industry is in a period of transformation, shifting from a "major construction country" to a "strong construction country," with the core goal of improving the quality and efficiency of construction development. One path is to address inefficiency by reorganizing various links and processes.

The development goal is to build a modern construction industry system, promote industrialization, digitalization, and green transformation and upgrading of the construction industry, and build high-quality buildings and homes that meet the needs of the times and the people. The so-called "new-type construction industrialization" refers to using new-generation information technology to drive standardized design, component modularization, and mechanized construction, achieving systematic integrated design throughout the project lifecycle, lean production and construction, full industry chain integration, and promoting high efficiency, high quality, low consumption, and low emissions in construction. Design standardization requires vigorous development of prefabricated buildings and the establishment of a specialized, large-scale, and information-based production system based on standard components; component modularization means increasing the integration and innovative application of new technologies such as Building Information Modeling (BIM), the Internet, the Internet of Things, big data, cloud computing, mobile communications, artificial intelligence, and blockchain throughout the construction process; mechanized construction means improving the performance and efficiency of various construction machinery, increasing mechanization levels, accelerating the creation of construction industry internet platforms, and promoting the application of intelligent manufacturing production lines for steel structure components and prefabricated concrete components.

Accordingly, the future development of construction steel enterprises should focus on the "three new" aspects of the construction industry, namely new construction methods—such as fully assembled structures including structural, mechanical, electrical, and decoration, achieving house building like car manufacturing; new service industries—such as full-process consulting services, digital technologies including project-level BIM, enterprise-level ERP, city-level CIM services, etc.; and new business formats—focusing on "investment-construction-operation," urban renewal, assembly +, digital transformation and upgrading, the construction industry's "dual carbon" goals, and projects related to the "dual circulation" going global.

(1) Grasp material changes to promote product structure adjustment

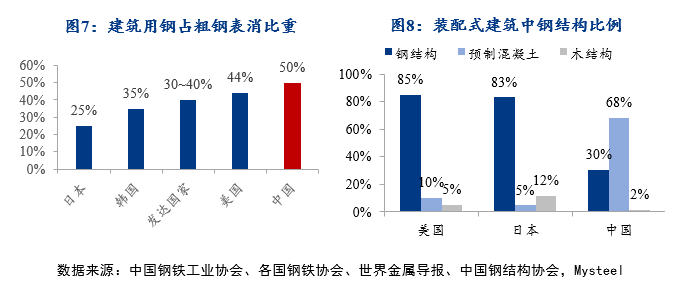

After reaching peak crude steel production, developed countries generally experience a 30-50% decline in output over a 10-20 year adjustment period, with per capita crude steel consumption stabilizing at 40-60% of the peak. Meanwhile, steel used in construction accounts for 30-40% of crude steel consumption in developed countries, whereas in China, the proportion is relatively high, about 50% in 2024. Currently, both the volume and proportion of steel used in China's construction industry are declining; in 2024, construction steel usage is about 450 million tons, a year-on-year decrease of approximately 30 million tons, accounting for about 50% of crude steel consumption, down 2 percentage points from the previous year.

In developed countries, steel structures account for about 70% of construction steel, while in China it is only 20%. In 2024, national steel structure production is about 91.48 million tons, accounting for 9% of crude steel output, still significantly lower than the 20-30% level in developed countries. The promotion of steel structures mainly drives the development of plate and profile varieties. Currently, China's steel structure processing and manufacturing is mainly plate-based, accounting for over 65%, with section steel accounting for 15%-20%. Developed countries have hot-rolled profiles accounting for 40-60% of steel structure processing volume, indicating significant room for growth in China's profile steel.

Construction steel enterprises can leverage material forms as a starting point, combining five key elements: "enterprise foundation, regional market, demand drivers, policy flags, and cost factors" to promote product structure adjustment based on actual conditions. The enterprise foundation refers to technical reserves, production line compatibility, financial strength, etc.; the regional market means local supply-demand balance, competitive landscape, market orientation, etc.; demand drivers focus on downstream demand support strength, such as long-to-plate, general-to-special transformations; policy flags include development directions like high-strength lightweight, weather resistance and seismic resistance, green and low carbon; cost factors consider market share, local self-sufficiency, capacity utilization, and comprehensive costs.

(2) Grasp efficiency improvement to transition from material suppliers to supply chain partners

The essence of "industrialized construction" is to shift the construction industry from "project customization" to "product manufacturing." This includes production process reengineering, construction technology innovation, and digital management. Production process reengineering involves: 1) integrated production: achieving seamless connection from raw materials to finished products through highly coordinated supply chains and continuous flow production; 2) modular manufacturing: breaking products into standardized functional modules, enabling diverse customization through flexible combinations; 3) lean construction: eliminating waste throughout the process, continuous improvement, and full participation to maximize value.

The best way for the construction industry to improve efficiency in the future is to learn from manufacturing. For example, the shipbuilding industry fully practices "integrated production," considering the entire production process during the design phase; the automotive industry widely applies "modular manufacturing," with many parts manufacturers and final vehicle assembly. The construction industry can also learn and adopt this approach by integrating design, production, and construction, developing a new construction model that combines factory mass production with on-site construction through a mix of standardized and customized products, balancing individual building needs with efficient factory production.

Construction steel enterprises should proactively adapt to industry changes, upgrading from "single material suppliers" to "comprehensive supply chain service providers." They should align products with new construction methods, provide integrated solutions in services, and incorporate lean manufacturing thinking in management. By actively adjusting positioning and deepening supply chain collaboration, they can jointly support industry progress and promote China's transition from a "major construction country" to a "strong construction country."

Keywords: The Breakthrough Path for Steel Enterprises under the Transformation and Upgrading of the Construction Industry

Related Information

Company News

-

Chuangcai’s latest news: Trump puts further pressure on Iran, and coke prices see their first round of increase.

Time:2026-01-29

-

We warmly welcome UAE customers to visit our color-coated and galvanized steel plants.

Time:2026-01-27

-

Warmly celebrate that our Nepalese customer has successfully passed the inspection of all company products.

Time:2026-01-23

-

Chuangcai Group Co., Ltd. launches bright-finish galvanized steel sheets, leading the industry with advanced technology and superior quality.

Time:2026-01-14

-

Warm Celebration of the First Perfect Cooperation between Chuangcai Group Co., Ltd. and Azerbaijani Customers

Time:2025-12-16

-

Warmly celebrate the great success of Chuangcai Group Co., Ltd. at the Dubai exhibition.

Time:2025-12-02

-

Morning reading: The "14th Five-Year" Plan proposal clearly outlines the development direction and opportunities for the steel industry.

Time:2025-10-29

-

Special Meeting on Creative Color Group Corporation's Strategy for Managing Risks in the Indian Market

Time:2025-10-16

-

Warmly celebrate Chuangcai Group Co., Ltd.'s successful participation in Alibaba International's "Heroes Contest, Billion Battle to Fame" high-quality customer negotiation training.

Time:2025-09-15

-

Morning Reading: Iron ore prices rise above $105, first round of coke price reductions implemented

Time:2025-09-09

-

Warmly celebrate Shandong Longjian Board Industry Co., Ltd. for successfully passing the ISO9001 certification

Time:2025-09-05

-

Internal Company International Business Knowledge Collision: Wisdom Integration, Expanding Global Perspectives Together

Time:2025-09-02

-

Two groups of Indian clients visited the factory, securing 3.000 tons of new orders

Time:2025-08-15

-

What industries use galvanized steel sheets? What types are there?

Time:2025-01-08

-

What are the main applications of galvanized materials?

Time:2025-01-08

-

How to distinguish between galvanized sheet and cold-rolled sheet

Time:2025-01-08

-

The difference between galvanized steel sheet and cold-rolled steel sheet

Time:2025-01-08

Industry News

-

Chuangcai’s Interpretation: The Fed’s Future Policy Direction Still Holds Uncertainty—A Brief Analysis of “Interest Rate Cuts, Balance Sheet Reduction, and a Stable U.S. Dollar”

Time:2026-02-03

-

The global precious metals market plunges; China’s Hubei steel mills conduct winter stockpiling surveys.

Time:2026-02-02

-

Chuangcai Latest News: Supply Increase and Demand Decrease for China's Five Major Steel Products, Chief Outlook on February Steel Prices

Time:2026-01-30

-

China Iron and Steel Association: Production Status of Plate and Strip Products from Key Statistical Enterprises as of December 2025

Time:2026-01-28

-

ChuangCai Consulting: Global crude steel production is projected to reach 1849 million tons in 2025, with a general rise in international commodity prices.

Time:2026-01-26

-

What structural changes will occur in China’s steel demand in 2026?

Time:2026-01-23

-

In the fourth quarter of 2025, Fortescue Metals Group in Australia is expected to produce 49.8 million tons of iron ore, a 2% decrease year-on-year.

Time:2026-01-22

-

This year, the enthusiasm for winter stockpiling of construction steel in Shandong Province, China, has cooled down, and winter inventories will continue to decline.

Time:2026-01-21

-

In 2025, China exported 6,690 ships, a year-on-year increase of 16.2%.

Time:2026-01-19

-

International commodity prices are rising across the board, and several countries are urging their citizens to leave Iran.

Time:2026-01-15

-

China’s latest advisory news: Trump says he’s canceling all talks with Iranian officials; steel futures rise in overnight trading.

Time:2026-01-14

-

China Shagang’s scrap steel prices rise by 50 yuan; China Ansteel, Bensteel, and Linggang announce February price adjustments.

Time:2026-01-13

-

The State Council executive meeting deploys policies to boost domestic demand; Zhongtian Steel and Yonggang announce their latest price adjustments.

Time:2026-01-12

-

Pressure Eases, Resilience Remains—A Forecast of the Impact of Global Steel Trade Remedies on China in 2026

Time:2026-01-09

-

Steel has it all wrapped up at the Northeastern University EXP Building in Boston

Time:2026-01-08

-

Steel-Based Zero Energy Building (ZEB) Inaugurated in India

Time:2026-01-07

-

International bulk commodities generally surged, while black commodity futures fell during the night session.

Time:2026-01-06

-

As the price pattern shifts to a narrowing “W” formation and regional coordination strengthens, can the 2026 stainless steel market maintain steady progress?

Time:2026-01-06

-

January cold-rolled prices may trend weaker.

Time:2026-01-06

-

January Steel Market—Pre-Holiday Weak Realities Weigh Down Prices; Black-Steel Sector Awaits “Spring Surge”

Time:2025-12-29

-

Interpreting the Guidance of Import Coal Price Spreads on Domestic Coking Coal Price Volatility (Part 1)

Time:2025-12-29

-

2026 Steel Market Winter Stockpiling Outlook

Time:2025-12-25

-

The countdown for export licenses has begun! Can China’s galvanized sheet exports reach new highs again in 2026?

Time:2025-12-25

-

Li Qiang called for planning a batch of major projects and undertakings that can drive the overall situation.

Time:2025-12-23

-

Value Equilibrium—A 2026 Outlook for China’s Steel Market

Time:2025-12-22

-

The Ministry of Commerce responds to the management of steel export licenses, and Jiangsu’s winter stockpiling of scrap steel shrinks in scale.

Time:2025-12-20

-

2026 Steel Indirect Export Forecast

Time:2025-12-18

-

Analysis of the Impact of Implementing Export License Management for Seamless Pipe Products and Enterprises’ Response Strategies

Time:2025-12-18

-

Luo Tiejun calls for jointly breaking the cycle of involutionary competition; the chief analyst of sheet and strip forecasts January steel prices.

Time:2025-12-16

-

Multiple ministries are promoting measures to combat “involution”; interpretation of the management of steel export licenses.

Time:2025-12-16

-

The Federal Reserve cut interest rates by 25 basis points, while Zhongtian rebar prices were raised by 50 yuan.

Time:2025-12-11

-

During the 14th Five-Year Plan, China’s steel industry is exploring a path toward reducing output while improving quality.

Time:2025-12-11

-

Multiple regions have activated emergency responses for severe pollution, and the scale of maintenance at steel mills has expanded.

Time:2025-12-11

-

Summary of the Jiangsu Steel Industry Chain Access White List; Shortage of Building Materials Specifications in Yunnan and Guizhou

Time:2025-12-03

-

Steel mills are expanding the scale of production cuts and maintenance, and steel billets in Tangshan rose over the weekend.

Time:2025-12-01

-

The NDRC is promoting measures to address disorderly price competition; this week, steel supply has increased while demand has declined.

Time:2025-12-01

-

Iron ore prices surged above $105, and the yuan-to-dollar exchange rate hit a more than one-year high.

Time:2025-11-27

-

Xi Jinping Holds Telephone Conversation with Trump; International Commodity Prices Rise

Time:2025-11-27

-

Several Federal Reserve officials signaled potential interest rate cuts, while Shagang's scrap steel prices were lowered.

Time:2025-11-24

-

Black futures fell in the night session, with electric furnace steel mills posting a loss of 117 yuan per ton.

Time:2025-11-20

-

International commodity prices fell across the board, while five steel mills raised their prices.

Time:2025-11-18

-

More construction material steel plants have resumed production, and inspection teams will gradually begin operations in the Beijing-Tianjin-Hebei region.

Time:2025-11-17

-

Black futures fell during the night trading session, as the Simandou iron ore project will gradually ramp up its production capacity.

Time:2025-11-13

-

Xinjiang steel plants reduce production during winter maintenance, while the U.S. temporarily suspends its export control rules on penetrating technologies.

Time:2025-11-12

-

In December, Baowu Steel raised prices amid a general rise in international commodity markets.

Time:2025-11-12

-

Supply and demand for the five major steel products both declined, with electric furnaces incurring a loss of 167 yuan per ton of steel.

Time:2025-11-07

-

Steel prices remained stable overall, while coking coal futures rose by more than 1%.

Time:2025-11-06

-

The Drivers Behind China's High Growth in Steel Exports and the Resulting Structural Changes

Time:2025-11-05

-

Morning Reading: 84 New Enterprises Proposed for Entry into Scrap Steel Processing, Baosteel Adjusts Production Capacity Goals

Time:2025-11-04

-

Morning Reading: The Ministry of Commerce Highlights the Consensus Reached in China-U.S. Economic and Trade Talks, While 6 Steel Mills Raise Prices

Time:2025-10-31

-

Morning Read: China-U.S. Leaders to Hold Meeting, Fed Cuts Interest Rate by 25 Basis Points

Time:2025-10-30

-

Morning Read: "One Line, One Bureau, One Meeting" Makes a Strong Statement—Black Futures Turn Positive in Overnight Trading

Time:2025-10-28

-

Morning Read: China and the U.S. Reach Preliminary Consensus; Draft Opinions Sought on New Steel Capacity Replacement Plans

Time:2025-10-27

-

Morning Read: International commodity prices surged across the board, while supply and demand for the five major steel products both increased.

Time:2025-10-24

-

In the third quarter of 2025, Fortescue's iron ore production reached 50.8 million tons, representing a year-on-year increase of 6%.

Time:2025-10-23

-

Steel prices remain stagnant as the market awaits a breakthrough in macroeconomic conditions.

Time:2025-10-22

-

Morning Reading: China and the U.S. Agree to Hold a New Round of Economic and Trade Consultations; Steel Mills Reduce Production and Conduct Maintenance Inspections

Time:2025-10-20

-

Morning Reading: Sichuan's Steel Industry Advances Measures to Combat "Involution," While Several Steel Mills in Northern China Undertake Maintenance Overhauls.

Time:2025-10-16

-

Morning Reading: China Responds to U.S. Threat of Additional Tariffs on China, October North-to-South Steel Material Survey

Time:2025-10-13

-

Morning Reading: Two Departments Take Action to Address Unregulated Price Competition, Black Commodity Futures Turn Positive in Overnight Trading

Time:2025-10-10

-

Morning Reading: Steel inventories surged by 1.28 million tons during the holiday period; summary of performance for black commodity sectors

Time:2025-10-09

-

Morning reading: The State-owned Assets Supervision and Administration Commission urges central enterprises to take the lead in "fighting internal involution," as rebar prices fall below 3,100.

Time:2025-09-28

-

Morning Reading: Ministry of Commerce Counterattacks Mexico's China-Related Measures; Supply and Demand Both Rise for Five Major Steel Products

Time:2025-09-26

-

After the National Day holiday, the price of hot-rolled strip steel in China may rise first and then decline

Time:2025-09-25

-

South Korea's K-Steel bill is impacting our country's steel exports, and the three major coal import ports will shut down.

Time:2025-09-24

-

Black Metal Regular Meeting: This week, the steel market showed mixed trends, while raw materials may remain relatively strong.

Time:2025-09-23

-

Midday Report: Steel prices mainly rose, with coking coal futures climbing more than 5%.

Time:2025-09-16

-

A Brief Analysis of Profit Contraction Pressure on Domestic Tinplate Manufacturers

Time:2025-09-15

-

Afternoon Report: Localized Steel Price Increase, Iron Ore Futures Drop Over 1%

Time:2025-09-11

-

Morning reading: Latest survey on steel mill maintenance impact, structural steel production capacity adjustment enters a stable period

Time:2025-09-08

-

Morning reading: Tangshan Steel Plant resumes production in batches, Trump signs US-Japan trade agreement

Time:2025-09-05

-

Morning reading: Black futures declined in the night session, construction sites in Beijing-Tianjin-Hebei gradually resume work

Time:2025-09-04

-

The Breakthrough Path for Steel Enterprises under the Transformation and Upgrading of the Construction Industry

Time:2025-09-03

-

The steel market still has room to decline in September

Time:2025-09-02

-

Anti-dumping situation of foreign steel products against China from January to August

Time:2025-09-01

-

The European Union plans to eliminate tariffs on American industrial goods to alleviate the impact of car tariffs.

Time:2025-08-29

-

Reference | Interpretation of the second half market based on silicon steel supply and demand

Time:2025-08-28

-

WEEKLY SUMMARY: China's steel market slides on weak fundamentals

Time:2025-08-25

-

WEEKLY: Chinese mills' steel stocks edge down

Time:2025-08-22

-

Việt Nam imposes anti-dumping duties on Chinese and South Korean coated steel

Time:2025-08-19

-

Vietnam imposes AD duties on galvanized steel from China, South Korea

Time:2025-08-19

-

Detailed explanation of color-coated steel sheet types, colors, and applications

Time:2025-02-27

-

What is cold-rolled sheet material? A comprehensive analysis of the characteristics and applications of cold-rolled sheet.

Time:2025-01-08

-

Advantages and Applications of Cold-Rolled Sheet

Time:2025-01-08

-

Applications and characteristics of color-coated steel sheets

Time:2025-01-08

-

Detailed explanation of the function and advantages of color-coated steel plate

Time:2025-01-08

-

What thickness and width of stainless steel do you require?

Time:2025-01-08